1. Decide to buy

Home ownership is one of the most secure ways to build wealth. It lays the foundation for a life of financial security and personal choice. There are solid financial reasons to support your decision to buy a home, and, among these, equity buildup, value appreciation, and tax benefits stand out. Buying a home doesn’t have to be complicated –we will guide you every step of the way and take into account the whole picture. If a home purchase meets your long term and financial goals, the time is probably right! The best way to get closer to buying your ultimate dream home is to buy your first home now.

2. Hire Legacy Realty Network

A real estate transaction involves numerous parties (not just buyer/seller). Utilizing our strong communication skills and expert real estate knowledge, we see ourselves as your guide, advocate and project manager. Your goals and best interests are always at the forefront.

3. Secure financing

An integral part of your home buying team is your lender/mortgage broker. Making the decision to buy a home is thrilling and can also be overwhelming. Getting preapproved with a lender will help provide guidance on what you are qualified to purchase and also help clarify what you feel comfortable with paying on a monthly basis.

4. Protect your investment after closing

After you close escrow on your house, we will still be here to advocate, connect and empower you! Our clients are family. Whether it’s questions about your property tax bill, vendor requests, market updates, or maintenance suggestions, our services do not end upon handing over keys. Our client base has continued to grow because of referrals from past clients. We promise to provide the same level of care and service to all of our clients.

1. Preapproval

It is strongly recommended buyers get pre-approved before beginning their home search. Knowing exactly how much you can comfortably spend on a home reduces the potential frustration of looking at homes outside of your budget.

2. What type of loan is best for you?

There are many types of loans and programs available to home buyers. A strong lender will help you look at all your options. Several types of loans include conventional, FHA, VA, and USDA. The terms can vary from 10 years - 30 years.

3. Review your monthly budget

Once you are preapproved, it is important to review your personal budget. Often, a preapproval is just bragging rights, the true monthly payment of the maximum amount the lender is willing to lend to you may be more than you want to spend. Know your budget and the maximum amount you want to spend each month on housing.

4. Down payment

The down payment is a critical part of purchasing a home. It is the percentage of the home’s purchase that a buyer pays upfront when they close on their home. Lenders often look at the down payment as your investment in the home. Different types of loans have different downpayment requirements and may require private mortgage insurance if the down payment is less than 20% of the home’s value.

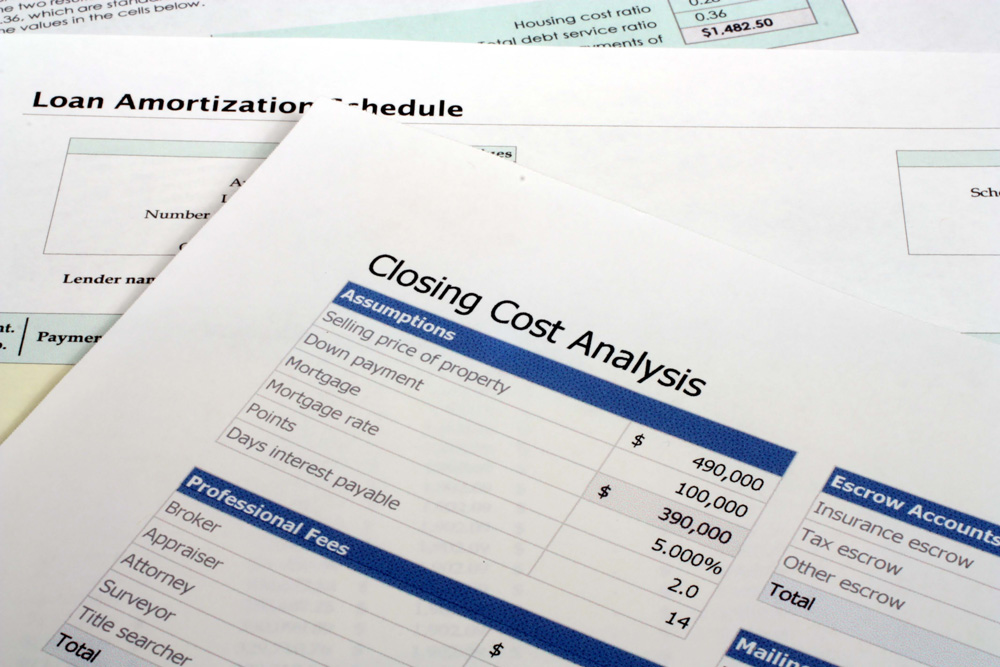

5. Closing costs

In addition to the downpayment, the average home buyer in California will need around 2-3% of the purchase price for closing costs. Closing costs are comprised of a variety of lender, escrow and other fees. Once you get an accepted offer, the escrow company can provide an estimate of these costs.

6. Account for maintenance and costs of homeownership

Homeownership has expenses that come with the responsibility of maintaining the asset. A good rule of thumb is to set aside 3-6 months of expenses into savings for unexpected repairs and maintenance.

Location, Location, Location

When looking to purchase a home, often, the first thoughts are about the home and its qualities. Our team will also encourage you to consider factors regarding WHERE you are looking to purchase. Where you buy not only affects the home’s current and future value, but it also affects your lifestyle. Below is a list of suggested factors to take into consideration when house hunting.

- Urban, suburban or rural feel (How close do you want your neighbors?)

- Neighborhood feel (Drive by at different times of the day, weekday vs weekend)

- Commute time to work

- Local schools (Check out greatschools.org)

- Proximity to restaurants and retail you enjoy

- Access to major highways

- Proximity to parks and recreation

- Access to airport and public transportation

- Access to health care facilities